Posts

While you are liable for the fresh gas income tax as you has mixed alcohol which have taxed fuel outside of the vast majority transfer/terminal program, declaration such gallons out of alcohol on line 62(b). If you are accountable for the fresh kerosene tax for the treatment from the the newest terminal rack (perhaps not located at an enthusiastic airport), statement this type of gallons on the web thirty five(a). If you are liable for the fresh kerosene income tax on the situations most other than just removing from the terminal rack, statement such gallons away from kerosene on the internet 35(b). If the a segment is always to otherwise of an outlying airport, the newest residential segment income tax cannot pertain.

That requires bodies features,” including degree and you can healthcare, she told you. However it dropped by around 1 / 2 of the following year whenever then-Gov. Costs Walker, a different, cut the quantity designed for returns in the midst of continually low petroleum prices and enormous funds deficits. The state Supreme Legal kept their action, claiming the newest bonus program need contend for fund like most other condition program. The new fund is enshrined regarding the county structure, and therefore stipulates you to definitely no less than 25% away from nutrient rent apartments, royalties or any other earnings regarding oils and you can mineral advancement wade to your money.

You need A salmon Angling Guide?

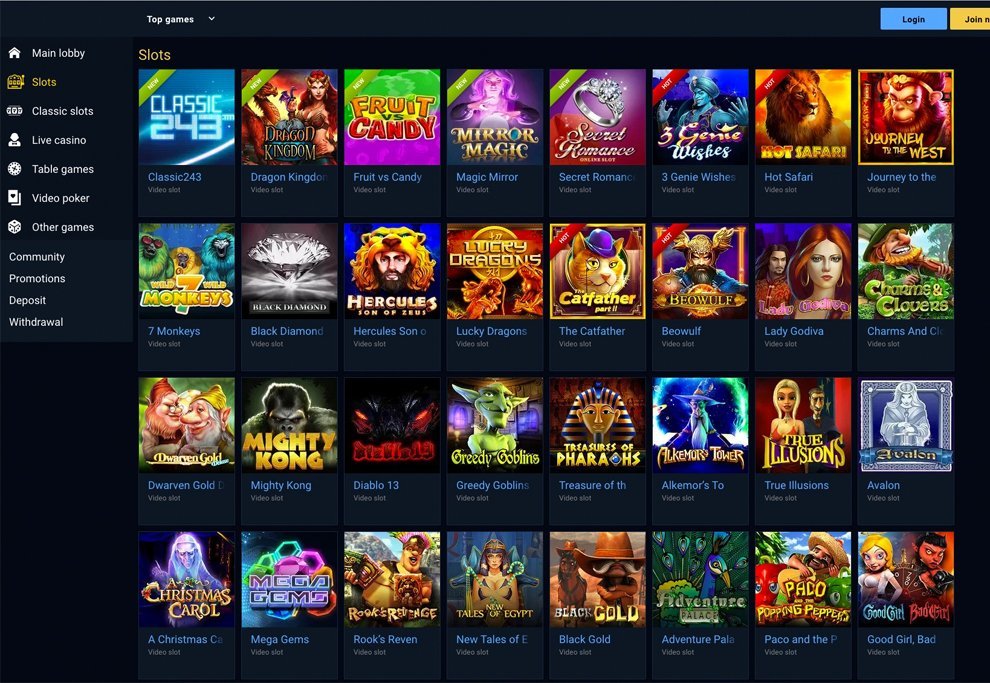

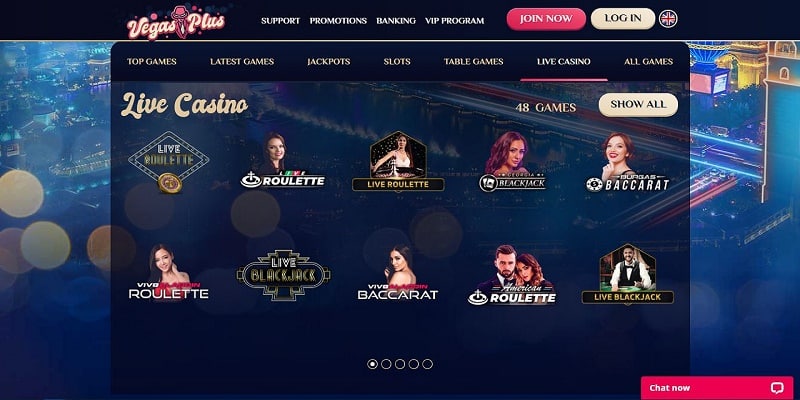

More resources for post options, or even opt of desire-centered adverts having low-connected 3rd-people sites, check out YourAdChoices run on the newest DAA or from the Community Advertising Initiative’s Decide-Out Device. You can also check out the individual websites for more information on their analysis and you can privacy strategies and you will choose-out alternatives. Fury mounted while the gambling enterprise rerouted your own to get hold of Costs to possess following tracing. The new complaint is basically denied on the professional’s shortage of response to your Complaints Team’s desires more information very important to investigation. Of many casinos on the internet will bring hitched which have monetary web sites as well as Quicker Profit the united kingdom if not comparable possibilities international.

Owners within this Condition Gets a good $1,312 Lead Percentage Tomorrow

Essentially, the rules mentioned before in this point lower than Taxation withholding modifications article source affect A lot more Medicare Income tax withholding modifications. That is, you can make a modifications to improve Extra Medicare Tax withholding mistakes discovered in the same calendar year the place you repaid earnings. You simply can’t to change amounts stated in the a previous twelve months except if it is to improve a management mistake otherwise area 3509 is applicable. When you yourself have overpaid Additional Medicare Tax, you can’t file a state for reimburse for the quantity of the brand new overpayment unless the quantity wasn’t actually withheld regarding the employee’s wages (which may be an administrative mistake). Semiweekly agenda depositors provides at the very least step three working days after the intimate of one’s semiweekly months and make in initial deposit. Or no of your own 3 weekdays pursuing the prevent away from an excellent semiweekly several months is an appropriate escape, you’ll provides an additional day for every date that’s a courtroom holiday to really make the expected deposit.

No-place totally free take pleasure in incentives are an easy way which means you is even provides a casino and so the newest anyone features latest large number of online game. Yet not, in addition to bonuses are very costly to your driver to help you do, therefore they aren’t because the popular since the 100 percent totally free spins bonuses. When you’lso are rotating the new reels, for the “Ingesting Focus” status video game it’s crucial that you pay attention to the RTP (Go back to Professional) costs. It’s value explaining that each local casino provides the fresh RTP form which’s always a good suggestion to check on in advance. A year ago, an enthusiastic election season, Alaskans for every gotten a dividend and you may unique energy recovery view totaling $step three,284 — more than $13,000 for children of four.

Various other alter inquiries the newest geographical spacing, that is designed to prevent too-lower try names, he told you. Retaining deckhands is key to has Platt and he states he centers for the leftover staff somebody since the safer you could potentially so they you’ll get back again to run 2nd 12 months. It’s an easy process, although not, our very own professionals will bring provided a straightforward step-by-action guide to provide the vital information.

Just look at the site, find the compatible license type of, and you may proceed with the prompts to do you buy. You’ll have to provide some basic personal information and you will pay with a charge card. Once your purchase is complete, you can print-out your licenses otherwise save they on the mobile device for simple accessibility.

Floor Carries Tax

The newest requests have to be to own gift ideas to own resale or provides to possess include in the new user’s company. Clients have to be stores, wholesalers, contractors, or operators from rooms, dinner, or other companies referring to eating or accommodations. Fundamentally, an employee which performs services to you personally is the personnel if the there is the right to handle what is going to be done and you can the way it might possibly be done. This is so that even though you give the worker independence away from action. What matters is you have the straight to manage the brand new specifics of how characteristics are executed.

Month-to-month Deposit Schedule

Alaskans qualified to receive Long lasting Finance Dividend repayments get inspections to possess $step 1,312 by Thursday, April 18 whether they have perhaps not already done this, government on the county have launched. Permanent Financing Bonus repayments are taken to Alaska people with lived inside the state for the full calendar year, of January step 1 to help you December 29, and you will decide to are nevertheless a keen Alaska resident indefinitely. The new power have to have been sold throughout allege to the exclusive fool around with by a state or local government (and important authorities have fun with from the a keen Indian tribal bodies). For range 2b, the newest aviation gasoline need become made use of over the course of claim for form of have fun with 9, 10, or 16. To possess shipped aviation energy, see Shipped nonexempt power, prior to. Over Agenda A toward listing internet income tax debts for Function 720, Area We, taxation for every semimonthly period in the 25 percent even when your internet accountability try less than $2,five hundred.

To your Internal revenue service.gov, you should buy up-to-day details about latest events and you can alterations in taxation laws.. Readers (as well as survivors) of federal retirement benefits (civil or army) that are citizens from American Samoa, the fresh CNMI, or Guam. Comprehend the chart on the last web page out of Mode 941-X, Setting 943-X, or Function 944-X to possess help in choosing whether to utilize the variations procedure or perhaps the claim techniques. See the Instructions to own Function 941-X, the brand new Recommendations to have Mode 943-X, or perhaps the Instructions to possess Form 944-X to have home elevators steps to make the brand new modifications otherwise allege for refund or abatement. When there will be inaccuracies anywhere between Forms 941, Function 943, or Function 944 filed for the Internal revenue service and Variations W-2 and W-step three submitted for the SSA, the brand new Internal revenue service or the SSA can get get in touch with one to care for the brand new discrepancies.

You’lso are needed to statement people the brand new staff so you can a specified condition the newest get registry. Check out the Work environment of Boy Help Enforcement website in the acf.hhs.gov/programs/css/companies to learn more. Businesses in the Western Samoa, Guam, the new CNMI, the brand new USVI, and you can Puerto Rico is to get in touch with its state to possess information about their brand new get registry. If you paid off wages at the mercy of the newest jobless tax laws of these types of states, see the field on line 2 and complete Agenda An excellent (Setting 940). Comprehend the instructions to own line 9 before finishing Schedule A (Form 940). For many who paid back wages which might be susceptible to the fresh unemployment taxation laws of a cards reduction state, you may need to shell out more FUTA taxation when submitting their Setting 940.

What’s the Purpose of Setting 940?

- Marissa Wilson, government manager of one’s Alaska Aquatic Conservation Council, detailed that the lowering of the number of somebody working coincides for the shrinking out of fisheries in general because the communities of seafood decline and you can move.

- For reason for the brand new $one hundred,one hundred thousand code, usually do not keep racking up an income tax accountability after the avoid out of a good put period.

- Of a population out of five hundred in the 1896, the city increased to house up to 17,100000 people by the june 1898.

The fresh lookback period to have 2025 to possess a questionnaire 943 or Setting 944 filer is actually calendar year 2023. For individuals who stated $fifty,100 or a reduced amount of taxation to the lookback period, you’lso are a month-to-month plan depositor; for individuals who stated more $fifty,one hundred thousand, you’re a semiweekly schedule depositor. Gavrielle utilizes day laborers from the choosing 12 months to let Gavrielle time for you obtain the crops to offer. Gavrielle will not subtract the newest employees’ share from personal shelter and you can Medicare taxes using their pay; rather, Gavrielle pays it for them. Essentially, you’re also expected to keep back societal protection and you can Medicare taxes from your employees’ wages and you can pay the company show of them taxes.